Jefferson alumni at center of stock market controversy

February 1, 2021

Vladmir Tenev, CEO of the popular online brokerage Robinhood and a Jefferson class of 2004 graduate, is now the subject of a barrage of online attacks and accusations after making the decision to bar Robinhood users from purchasing shares in Gamestop (GME) and AMC Entertainment Holding (AMC), among other volatile stocks.

Robinhood chose to restrict trading on select stocks on Jan. 28, preventing users from buying–but not selling–these stocks. This came after members of the popular subreddit WallStreetBets (WSB) caused stocks that had been targeted by short-selling hedge-funds to surge in price.

“GameStop is an old company in an innovative sector. They got left behind when ESports took a lead in the industry. With poor fundamentals, it was an easy short for hedge funds. Retail investors could never have the power like hedge funds do when they manipulate markets, but they figured out through WallStreetBets that they can organize trades to do so,” senior and president of Investment Club Arjun Dhumne said.

With investors able to unload certain stocks but not purchase them, Robinhood’s decision caused a massive dip in the prices of GME, AMC, and other targets of WSB.

“After seeing the unethical actions of hedge funds and the logical reasoning behind pumping GME-like stocks, I did decide to back NOK due to its recent 5G plan announcement,” junior Pranav Ravella said. “I did not lose that much money, but some of my friends that gained $100,000 the day before on AMC lost half of it.”

Other brokerages also restricted trading, but because Robinhood had become successful largely due to its mission of “democratizing finance,” the reaction from WSB members and other retail investors towards Tenev and Robinhood was especially visceral.

Out of anger, many Robinhood users took to social media to express their discontent with the platform’s decision. Most notably, Barstool Sports founder and WSB-enthusiast Dave Portnoy labeled Tenev on Twitter as a “fraud, liar, and scumbag” and edited pics of him to add a clown nose. Jefferson students such as junior Zander Kuebler were also unhappy about the company’s decision.

“For a company named after an individual who stole from the rich and gave to the poor, [by] restricting access to the stock for retail investors who use their platform, they are catering to the desires of the rich,” Keubler, a Robinhood user, said. “At the end of the month, I will be leaving Robinhood and transferring my funds to a different brokerage.”

Likewise, junior Irfan Nafi–who had been using Robinhood up until September, leaving investing altogether thereafter to focus on school–does not necessarily condone Robinhood’s actions. Despite this, however, he may consider returning to the brokerage once he continues investing.

“If I was actually investing right now, I would not have invested in a stock like that. Honestly, I might just go back to Robinhood, because it’s not going to be that much of an issue if you’re just investing in mainstream stocks and biotech stocks,” Nafi said.

Tenev later appeared on media networks in an attempt to clear up misconceptions, stating that Robinhood placed these trading restrictions to better manage the amount of collateral required by The Depository Trust & Clearing Corp. (DTCC)–the primary U.S. stock trade clearinghouse. The U.S. Security and Exchange Commission (SEC) is currently looking into the situation for potential misconduct.

“I feel like though the co-founder was from Jefferson and it sheds light on the character of our school, it doesn’t really represent the people we have at Jefferson right now,” Ravella said. “As with every competitive environment, there are going to be people that are unethical, but that should not cloud the rest of the amazing people and alumni we have at our school.”

tjTODAY reached out to Tenev for comment but did not receive a response.

This story was originally published on tjTODAY on January 29, 2021.

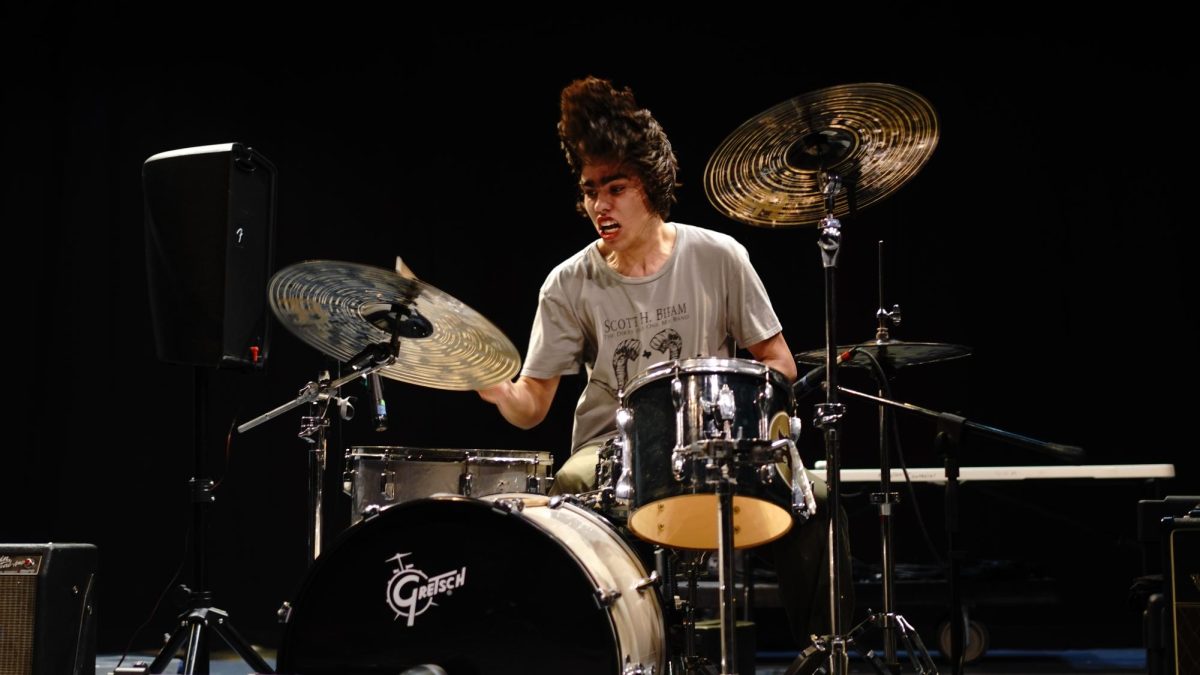

![IN THE SPOTLIGHT: Junior Zalie Mann performs “I Love to Cry at Weddings,” an ensemble piece from the fall musical Sweet Charity, to prospective students during the Fine Arts Showcase on Wednesday, Nov. 8. The showcase is a compilation of performances and demonstrations from each fine arts strand offered at McCallum. This show is put on so that prospective students can see if they are interested in joining an academy or major.

Sweet Charity originally ran the weekends of Sept. 28 and Oct. 8, but made a comeback for the Fine Arts Showcase.

“[Being at the front in the spotlight] is my favorite part of the whole dance, so I was super happy to be on stage performing and smiling at the audience,” Mann said.

Mann performed in both the musical theatre performance and dance excerpt “Ethereal,” a contemporary piece choreographed by the new dance director Terrance Carson, in the showcase. With also being a dance ambassador, Mann got to talk about what MAC dance is, her experience and answer any questions the aspiring arts majors and their parents may have.

Caption by Maya Tackett.](https://bestofsno.com/wp-content/uploads/2024/02/53321803427_47cd17fe70_o-1-1200x800.jpg)

![SPREADING THE JOY: Sophomore Chim Becker poses with sophomores Cozbi Sims and Lou Davidson while manning a table at the Hispanic Heritage treat day during lunch of Sept 28. Becker is a part of the students of color alliance, who put together the activity to raise money for their club.

“It [the stand] was really fun because McCallum has a lot of latino kids,” Becker said. “And I think it was nice that I could share the stuff that I usually just have at home with people who have never tried it before.”

Becker recognizes the importance of celebrating Hispanic heritage at Mac.

“I think its important to celebrate,” Becker said. “Because our culture is awesome and super cool, and everybody should be able to learn about other cultures of the world.”

Caption by JoJo Barnard.](https://bestofsno.com/wp-content/uploads/2024/01/53221601352_4127a81c41_o-1200x675.jpg)