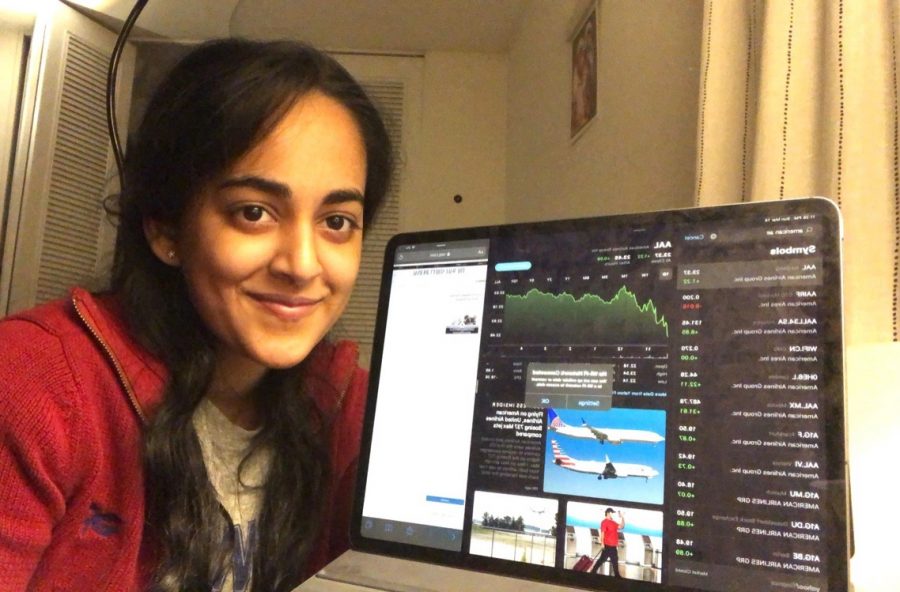

Senior Rainu George opens her stock holdings portfolio for the first time after COVID-19 air travel restrictions eased. Her screen lights up with green numbers and charts as she is faced with three words — “day’s gain: $200.”

Since she was 17, George has been an investor in the stock market with holdings in several companies. While the legal age of investing independently is 18, with the encouragement and assistance of her father George Kurian, a custodial investment account was opened for George to begin, a process he has done with all of his children.

George, now 18, first began to learn about the stock market at the age of 16; however, Kurian noted an apprehension at the start of the journey.

“Initially [my kids] were hesitant about investing but I pushed them to start. I wanted them to start at a young age so they can make mistakes now and learn from them. I want them to understand the basics of investing,” Kurian said.

However, becoming involved in the stock market at a young age has proven to be taxing at times. George expressed the pressures of self-managing her account and the responsibilities of handling real money.

“Sometimes it makes me stressed because it is actual money on the line, but I have [gotten] help and advice from my brother and my dad. But especially when [COVID-19] hit, everyone saw a huge decrease in their numbers — stuff like that can make you really nervous, but it’s important to stay calm and look at the bigger picture too in terms of stock market recovery and the stability of the company,” George said.

Learning from her father and older siblings, George has gained invaluable wisdom in terms of the smartest moves to make when buying into the market.

“It can be really tempting to pool your money into what seems like a promising investment when you’re first starting out, but that’s a really dangerous thought process. To minimize losses, it’s really important to split up where your money is going; right now, the majority of my shares are in Castor Maritime (CTRM), Northern Dynasty Minerals (NAK), PlayAGS Inc (AGS) and American Airlines (AAL), but there are more as well,” George said.

George’s knowledge extended into the correct time to buy into certain companies too. Despite COVID-19 causing a global stock market crash, George saw this as an opportunity to gain money which proved to be fruitful as she saw a gain of over $450 on her holdings of AAL alone after COVID-19 restrictions eased on air travel.

“When [COVID-19] hit, everything was going down with a lot of stocks halving in value and a lot even more than that, but in perspective, those numbers weren’t going to stay down forever. That was a really good time to invest because, as soon as some businesses started to recover from [COVID-19], they’d get their value back. I was able to make $450 on American Airlines after air travel was allowed again,” George said.

For the future, George believes that investing young has given her an opportunity to learn about managing finances in ways that can’t be done in school.

“It has taught me to independently learn many things when it comes to finance, to keep up with current news and ultimately where to invest. Though business is not my primary focus for an area of study in college, it is still an essential knowledge. I feel like I am ahead in terms of managing my finance and of course understanding the stock market,” George said.

George’s older brother Robin George, who also began investing at 17, has already begun to experience the emotional and financial benefits of going into the stock market early.

“As a college student, I understand the toll student loan debt has on students. I have definitely learned to be smart with my [finances]; instead of keeping all my savings in a savings account, I started investing to gain long-term profit in hopes that [it] can help me pay for debt. I think that having this as a cushion has helped me feel less nervous and will help Rainu as she goes into college too,” Robin George said.

Robin George explained how investing from a young age has benefited him in terms of staying on top of the financial world, drawing attention even to the benefits of making mistakes when investing.

“It was definitely worthwhile. Understanding the market at a young age puts you ahead of your peers. I was more willing to take risks with my investments as well and learn from my mistakes,” Robin George said.

Rainu George expressed her appreciation for having become a young investor and how it will continue to benefit her moving into adulthood.

“Investing taught me a lot about how to be smart with my money, but at the same time as that was happening, I was also able to see myself making money. Having investments in stocks will likely help me to pay off student loans, buy my first house and set me up for retirement. Having this knowledge has been and will continue to be indispensable,” George said.

This story was originally published on Blueprint on March 15, 2021.

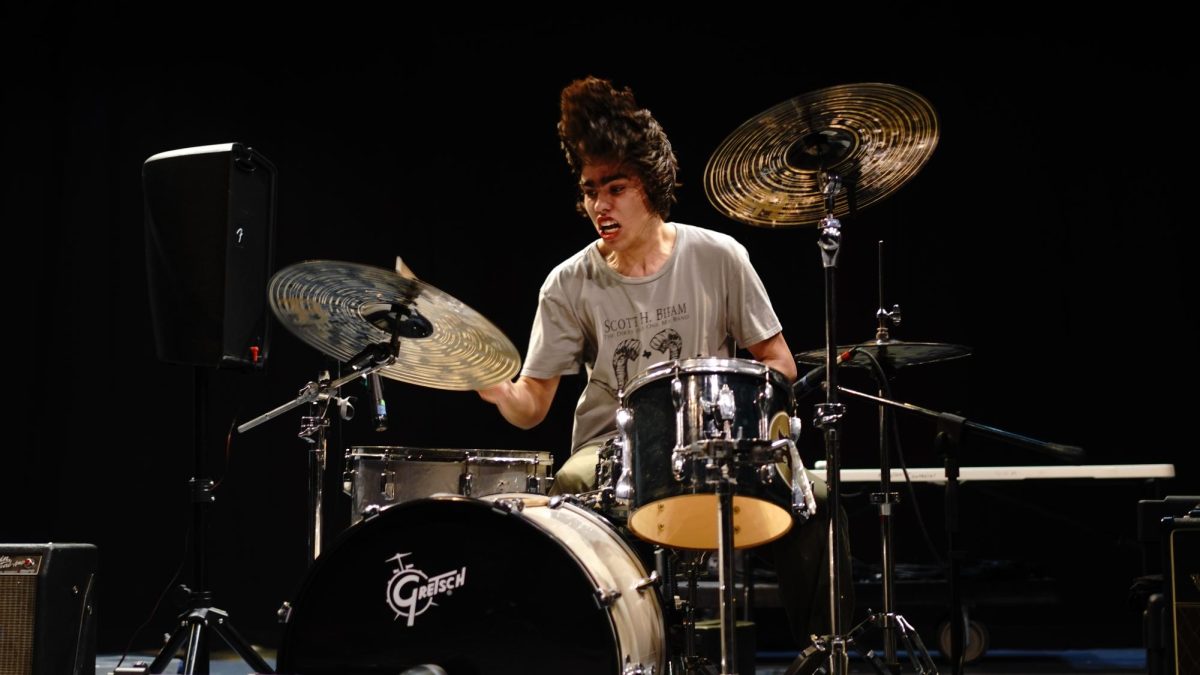

![IN THE SPOTLIGHT: Junior Zalie Mann performs “I Love to Cry at Weddings,” an ensemble piece from the fall musical Sweet Charity, to prospective students during the Fine Arts Showcase on Wednesday, Nov. 8. The showcase is a compilation of performances and demonstrations from each fine arts strand offered at McCallum. This show is put on so that prospective students can see if they are interested in joining an academy or major.

Sweet Charity originally ran the weekends of Sept. 28 and Oct. 8, but made a comeback for the Fine Arts Showcase.

“[Being at the front in the spotlight] is my favorite part of the whole dance, so I was super happy to be on stage performing and smiling at the audience,” Mann said.

Mann performed in both the musical theatre performance and dance excerpt “Ethereal,” a contemporary piece choreographed by the new dance director Terrance Carson, in the showcase. With also being a dance ambassador, Mann got to talk about what MAC dance is, her experience and answer any questions the aspiring arts majors and their parents may have.

Caption by Maya Tackett.](https://bestofsno.com/wp-content/uploads/2024/02/53321803427_47cd17fe70_o-1-1200x800.jpg)

![SPREADING THE JOY: Sophomore Chim Becker poses with sophomores Cozbi Sims and Lou Davidson while manning a table at the Hispanic Heritage treat day during lunch of Sept 28. Becker is a part of the students of color alliance, who put together the activity to raise money for their club.

“It [the stand] was really fun because McCallum has a lot of latino kids,” Becker said. “And I think it was nice that I could share the stuff that I usually just have at home with people who have never tried it before.”

Becker recognizes the importance of celebrating Hispanic heritage at Mac.

“I think its important to celebrate,” Becker said. “Because our culture is awesome and super cool, and everybody should be able to learn about other cultures of the world.”

Caption by JoJo Barnard.](https://bestofsno.com/wp-content/uploads/2024/01/53221601352_4127a81c41_o-1200x675.jpg)