Young investors

Exploring the different ways students at MVHS gained money through investing

March 29, 2021

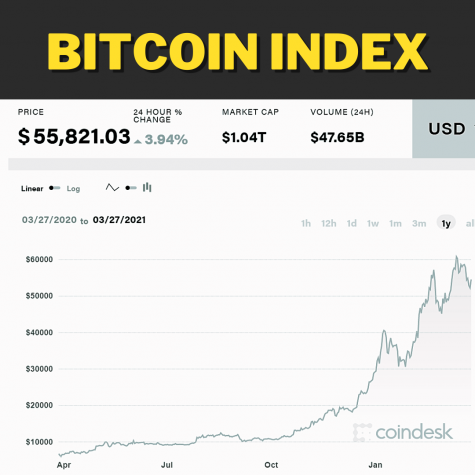

Initially a skeptic of Bitcoin, a well-known cryptocurrency, junior Anant Somani tried his chances last year, buying one bitcoin for the market value of around $12,000. After a year, the odds ruled in his favor, as the market price of Bitcoin had skyrocketed to over $57,000 per coin as of March 22, 2021, earning him around $45,000 in total.

When weighing how much he made through investing and how much he could have made by putting that money in a savings account — which typically has a savings interest of 0.04 percent average percentage yield (APY) — Somani made approximately 10,000 times more money through investing in Bitcoin. However, he concedes that there is still high risk in investing in the market.

“There’s really nothing guaranteed because no government has recognized them as a formal cryptocurrency,” Somani said. “So the second they say that, ‘You will not be able to use this in the future because it’s decentralized and we don’t want that; we want control over the populations,’ it just completely devalues. And people start selling it off [because] there’s no use for it.”

Senior Upasana Dilip recalls the times when her father exposed her to the world of stock exchange and market investments through reading daily news and watching television with her when she was 12 years old. Over time, she grew interested in scrolling through headlines from the Wall Street Journal and Investopedia to stay informed about different corporations on her own time. And when high school finally rolled around, she decided to join the world of investing.

Though it is “more risky than having your money in bank[s],” according to Dilip, the potential for growth through buying stocks outweighs that of storing money in banks with typically low interest rates.

After years of experience, similar to Somani, Dilip understands the high risks that trail behind each of her decisions while investing due to the unpredictable nature of the stock market.

“The last couple weeks, [the market index has] been super sharply [going] down,” Dilip said. “So if you just started putting money in a couple [of] weeks ago, then you would have lost probably hundreds of dollars.”

Aside from gaining financial literacy, investing has also taught Dilip what she refers to as “remarkable life-skills,” one of them being patience. When the market does not run in her favor, she learned to stay calm, not freak out and “pull out all [her] money and be like, ‘Oh my God! I never want to touch the stock market again.’”

Agreeing with Dilip, Somani recalls a time when the value of PayPal, a company he invested in, dipped from 300 to 262 dollars per share — he learned that the best strategy was to let the market do its job, as the values will bounce back up and “stabilize.” Historically, market stabilization has always been a trend, according to an article published by Zach from Four Pillars Freedom.

To determine which stocks to buy, Somani uses an entry and exit strategy, where he would analyze graphs of the companies’ value over a span of time and a myriad of other factors such as media coverage.

“If I see that a ton of people are selling a certain stock or buying a certain stock or just trading it, buying and selling, at a higher volume than it’s usually sold at, I know that it’s either getting more momentum in some aspects because more people know about it or more people are trading it, or it’s just getting more media coverage,” Somani said. “And when that happens, there’s a saying, ‘There’s no such thing as bad publicity.’”

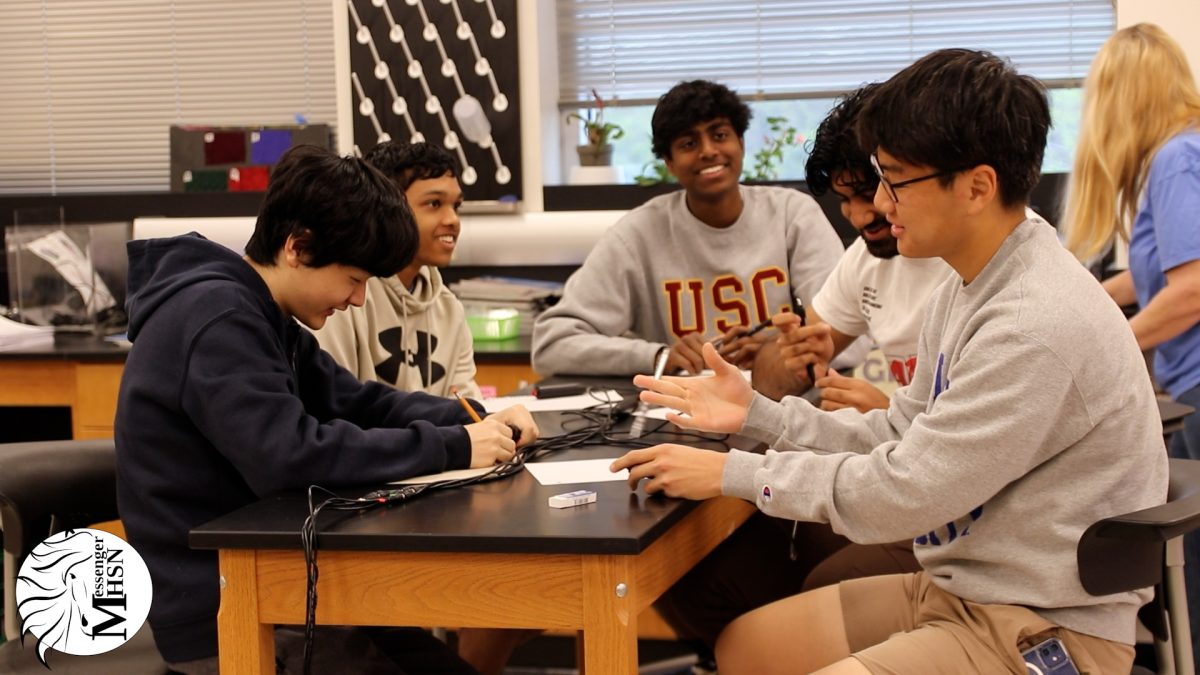

While stocks and cryptocurrency require having ample money to try one’s luck with, MVHS’ Microfinance Club invests in small businesses around the world through providing micro-loans, according to writer of the Investor’s Handbook Todd Lincoln. According to junior Suryateja Duvvuri, the club bases its concept on KIVA, a non-profit microfinancing company that connects low-income entrepreneurs with people like Duvvuri, who can lend money to help fund those start-ups.

With no interest rate in micro-lending, the club does not make much money — funding used for microloans is typically generated through school fundraisers and events. However, Duvvuri expresses that the Microfinance Club is less about making strategic moves that maximize profit and more about breaking down the barriers for low-income areas to experience economic and social growth through innovation. Thus, when making decisions about which start-up his team should invest in, they value and pinpoint certain factors such as the idea’s credibility, potential and mission statements.

As president of the club, Dilip also reveals that the team frequently engages in discussions to finalize on their investment partners, hoping to cover multiple areas that are in need of entrepreneurial initiatives.

“From a microfinance aspect, investing is super powerful because it’s not just donations or giving your money away, but it’s a way to recycle that money [to] help people,” Dilip said. “That amount of money could help build up an entire business, and that business could help build up the entire community around it because the people who are in charge of the business will probably be hiring employees from around where they live […] That small amount of money, 25 or 50 dollars, accumulates, and it’s a really cool way to help and see how the power of that little amount of money has a bigger impact than you would think.”

Dilip and Somani agree that individuals rarely invest during high school, as students tend to not have time or money. Nonetheless, to Somani, investing is just like any other commitment, be it a job, extracurriculars or internships — the key is to know “what you want to get out of investing,” and the reason for “valuing [certain investments] so high or so low.”

Though certain realms of investing remain unexplored by many MVHS students, it continues to be one of the most popular trends among adults who want to grow their money outside of banks, according to Mortgage, Home Buying and Credit Card expert and writer for Smart Asset Amelia Josephson. Whether it’s investing in small businesses or private companies, Dilip, Duvvuri and Somani believe that it’s never too early to start learning about money management and microfinance.

“Microfinance is a necessity — it’s a life skill that everyone should learn,” Duvvuri said. “Sure, there may be some business contexts, but I don’t entirely think that microfinance is solely based on pure business. It’s also based on the real-world application of business tools […] Just getting a glimpse or even learning a bit about microfinance and how [it] can be used to help people is a really great skill.”

This story was originally published on El Estoque on March 28, 2021.

![IN THE SPOTLIGHT: Junior Zalie Mann performs “I Love to Cry at Weddings,” an ensemble piece from the fall musical Sweet Charity, to prospective students during the Fine Arts Showcase on Wednesday, Nov. 8. The showcase is a compilation of performances and demonstrations from each fine arts strand offered at McCallum. This show is put on so that prospective students can see if they are interested in joining an academy or major.

Sweet Charity originally ran the weekends of Sept. 28 and Oct. 8, but made a comeback for the Fine Arts Showcase.

“[Being at the front in the spotlight] is my favorite part of the whole dance, so I was super happy to be on stage performing and smiling at the audience,” Mann said.

Mann performed in both the musical theatre performance and dance excerpt “Ethereal,” a contemporary piece choreographed by the new dance director Terrance Carson, in the showcase. With also being a dance ambassador, Mann got to talk about what MAC dance is, her experience and answer any questions the aspiring arts majors and their parents may have.

Caption by Maya Tackett.](https://bestofsno.com/wp-content/uploads/2024/02/53321803427_47cd17fe70_o-1-1200x800.jpg)

![SPREADING THE JOY: Sophomore Chim Becker poses with sophomores Cozbi Sims and Lou Davidson while manning a table at the Hispanic Heritage treat day during lunch of Sept 28. Becker is a part of the students of color alliance, who put together the activity to raise money for their club.

“It [the stand] was really fun because McCallum has a lot of latino kids,” Becker said. “And I think it was nice that I could share the stuff that I usually just have at home with people who have never tried it before.”

Becker recognizes the importance of celebrating Hispanic heritage at Mac.

“I think its important to celebrate,” Becker said. “Because our culture is awesome and super cool, and everybody should be able to learn about other cultures of the world.”

Caption by JoJo Barnard.](https://bestofsno.com/wp-content/uploads/2024/01/53221601352_4127a81c41_o-1200x675.jpg)