On Nov. 8, 2022, the City of San Francisco voted to approve Proposition M, establishing a vacancy tax on buildings with three or more vacant residential units left unoccupied for more than 182 days in a year. This measure is a sign that the city’s inhabitants are standing against a short-term rental system and the real estate market associated with it, encouraging landlords to adapt to an affordable housing system while combating homelessness at the same time.

San Francisco, while known for the Golden Gate Bridge and its rich history, is also known for its homelessness crisis spanning back to the late 1970s. The issue has spread across the city’s various mayoral administrations for years, resulting from failed and ineffective policies. Among some of the various factors that persist in homelessness are the housing crisis, gentrification and displacement from gentrification.

According to a 2019 point-in-time study by the U.S. Department of Housing and Urban Development, San Francisco ranked second place among the top 10 U.S. cities suffering from a homelessness crisis. Los Angeles came in third, and New York City ranked first. As Silicon Valley is often considered a preeminent hub for technology, prospective business people are often looking for ways to capitalize on their presence within the surrounding area by creating luxury residences that well-off individuals can afford, in comparison to the less fortunate who are in need of a home.

Due to zoning regulations, San Francisco suffers from a housing crisis, but it is not just paperwork and red tape that is preventing the homeless from being housed. For the economy of the city, the real estate market holds great influence, and many property owners leave their units vacant in hopes of driving up their property values. It is artificial inflation, and it is more of a profit scheme to get more money.

Proposition M utilizes the vacancy tax it is given to force property owners to sell their properties, open their units up for rent or pay more tax to the city to combat the homelessness problem it is contributing to. All these options are beneficial in different ways. Selling off properties allows for a percentage of homes to potentially become affordable for many to buy. Taxation of those unoccupied areas draws more revenue to the city, which can be diverted to fight homelessness.

By opening up units for rent, landlords have the option of expanding their preferences to Section 8 housing, or government-subsidized housing, giving lower income groups and homeless people a chance to inhabit a unit. Overall, the measure provides numerous opportunities for different groups, and it gives the lesser fortunate the ability to get back on their feet and not back on the streets.

While the artificial inflation of the real estate market is a contributing factor, Airbnbs are another issue that prevents people from owning a home. Airbnb is a service that allows anyone to rent out a home for a short period of time, no matter the location. It has given a rise to the short-term rental system, where properties function as mini hotels and can generate numerous profits for an owner. While the concept sounds beneficial, in practice, the system creates problems of its own.

According to a 2017 study conducted by the Social Science Research Network, an increase in Airbnb listings correlated to higher property values and rental rates, causing landlords to change their units from long-term to short-term rentals. This generates two problems. Firstly, it convinces owners to kick out their tenants to get more short-term tenants in, thus generating more potential homeless individuals. Secondly, it prevents the homeless and lesser fortunate from being capable of inhabiting a home. While Proposition M focuses more on buildings with rental units, it also dissuades landlords in apartment and condominium complexes from turning their properties into Airbnbs, as, oftentimes, properties may not be inhabited for long periods of time due to insufficient dates for vacations.

While there were opponents to the measure, many must understand that the benefits outweigh the risks. Proposition M’s vacancy tax generates new abundant revenue for the city that can be devoted to homelessness outreach and care services. In addition, it encourages owners to seek alternative means to their real estate investments, generating revenue for themselves through traditional rental or Section 8 housing programs. Those who are homeless or of lower income benefit as they gain new opportunities to inhabit a home, either through the encouragement of government-funded subsidies, programs or community-sponsored incentives.

Proposition M does not come without its own drawbacks, especially given the wording and nature of the bill. The nature of the bill targets investments in real estate, but it should also target empty homes, apartment buildings and so forth. The requirement of 182 days in a year should be decreased as it provides a lengthy time frame that could easily be circumvented.

Instead, landlords and property owners should be given one to two months as tenants should not be difficult to locate. Single family homes, especially for the wealthy, should be targeted as well rather than picking and choosing specific properties to levy the tax upon.

While Proposition M is a step in the right direction, it should be amended to define certain exceptions, extended dates, and additional properties that are left unscathed but still contribute to the homelessness crisis. It is necessary to help get homeless people back on their feet, not push them back onto the streets.

This story was originally published on The Roar on January 30, 2023.

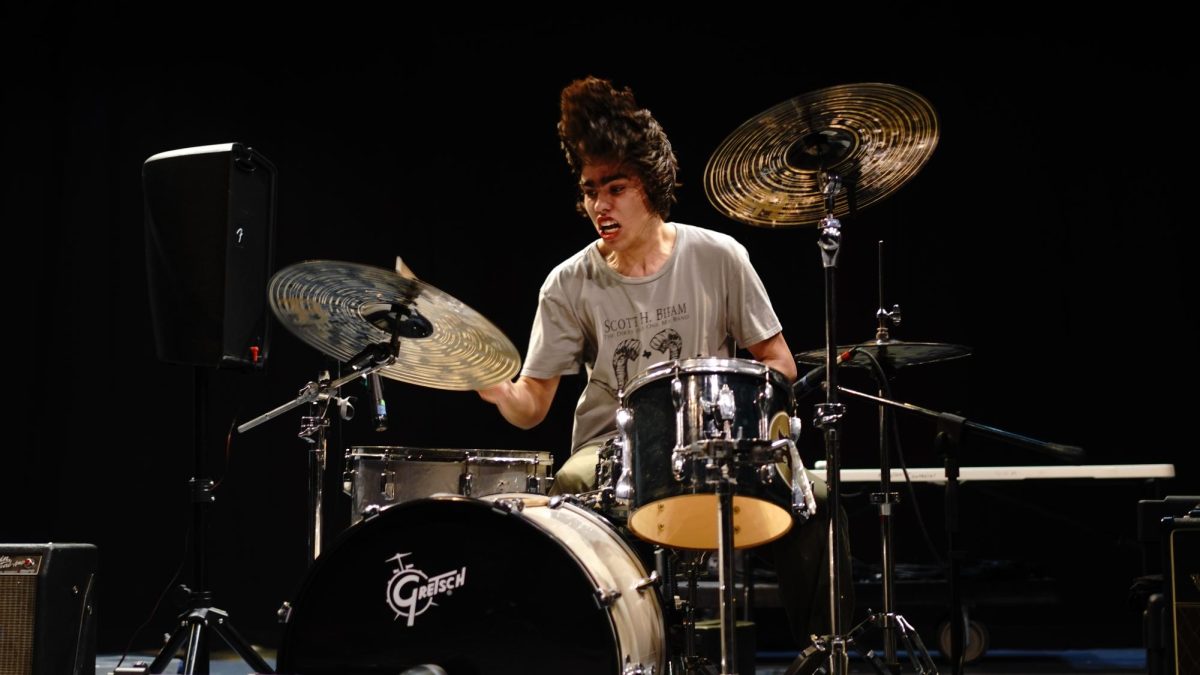

![IN THE SPOTLIGHT: Junior Zalie Mann performs “I Love to Cry at Weddings,” an ensemble piece from the fall musical Sweet Charity, to prospective students during the Fine Arts Showcase on Wednesday, Nov. 8. The showcase is a compilation of performances and demonstrations from each fine arts strand offered at McCallum. This show is put on so that prospective students can see if they are interested in joining an academy or major.

Sweet Charity originally ran the weekends of Sept. 28 and Oct. 8, but made a comeback for the Fine Arts Showcase.

“[Being at the front in the spotlight] is my favorite part of the whole dance, so I was super happy to be on stage performing and smiling at the audience,” Mann said.

Mann performed in both the musical theatre performance and dance excerpt “Ethereal,” a contemporary piece choreographed by the new dance director Terrance Carson, in the showcase. With also being a dance ambassador, Mann got to talk about what MAC dance is, her experience and answer any questions the aspiring arts majors and their parents may have.

Caption by Maya Tackett.](https://bestofsno.com/wp-content/uploads/2024/02/53321803427_47cd17fe70_o-1-1200x800.jpg)

![SPREADING THE JOY: Sophomore Chim Becker poses with sophomores Cozbi Sims and Lou Davidson while manning a table at the Hispanic Heritage treat day during lunch of Sept 28. Becker is a part of the students of color alliance, who put together the activity to raise money for their club.

“It [the stand] was really fun because McCallum has a lot of latino kids,” Becker said. “And I think it was nice that I could share the stuff that I usually just have at home with people who have never tried it before.”

Becker recognizes the importance of celebrating Hispanic heritage at Mac.

“I think its important to celebrate,” Becker said. “Because our culture is awesome and super cool, and everybody should be able to learn about other cultures of the world.”

Caption by JoJo Barnard.](https://bestofsno.com/wp-content/uploads/2024/01/53221601352_4127a81c41_o-1200x675.jpg)