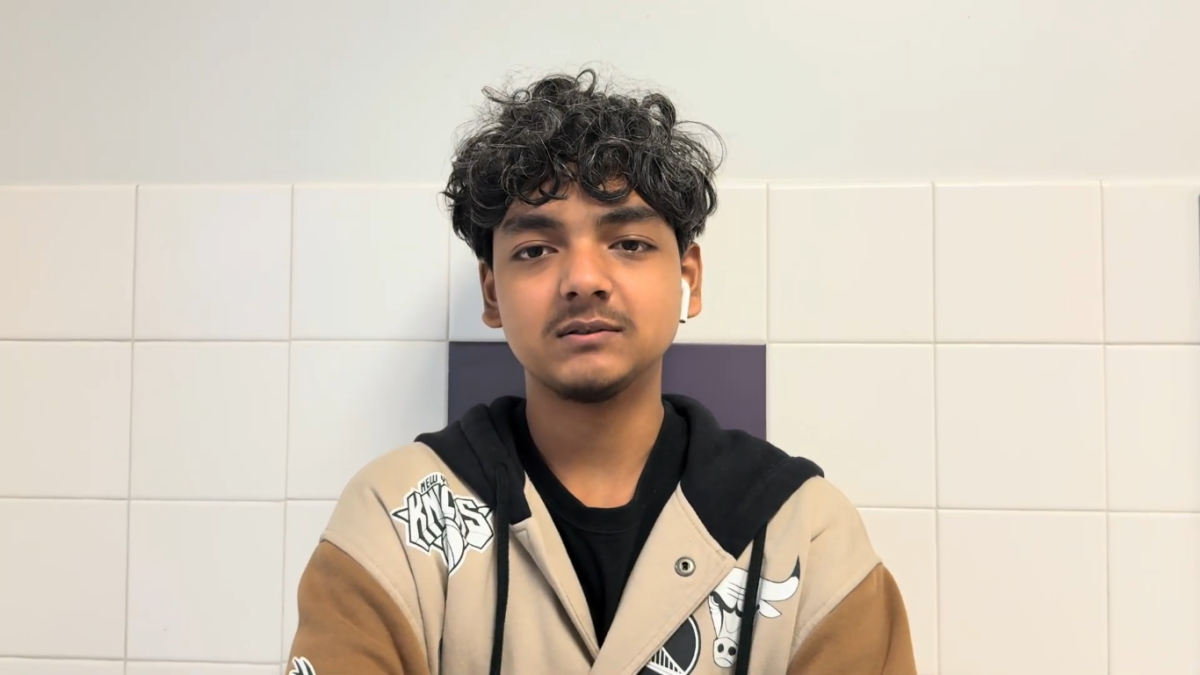

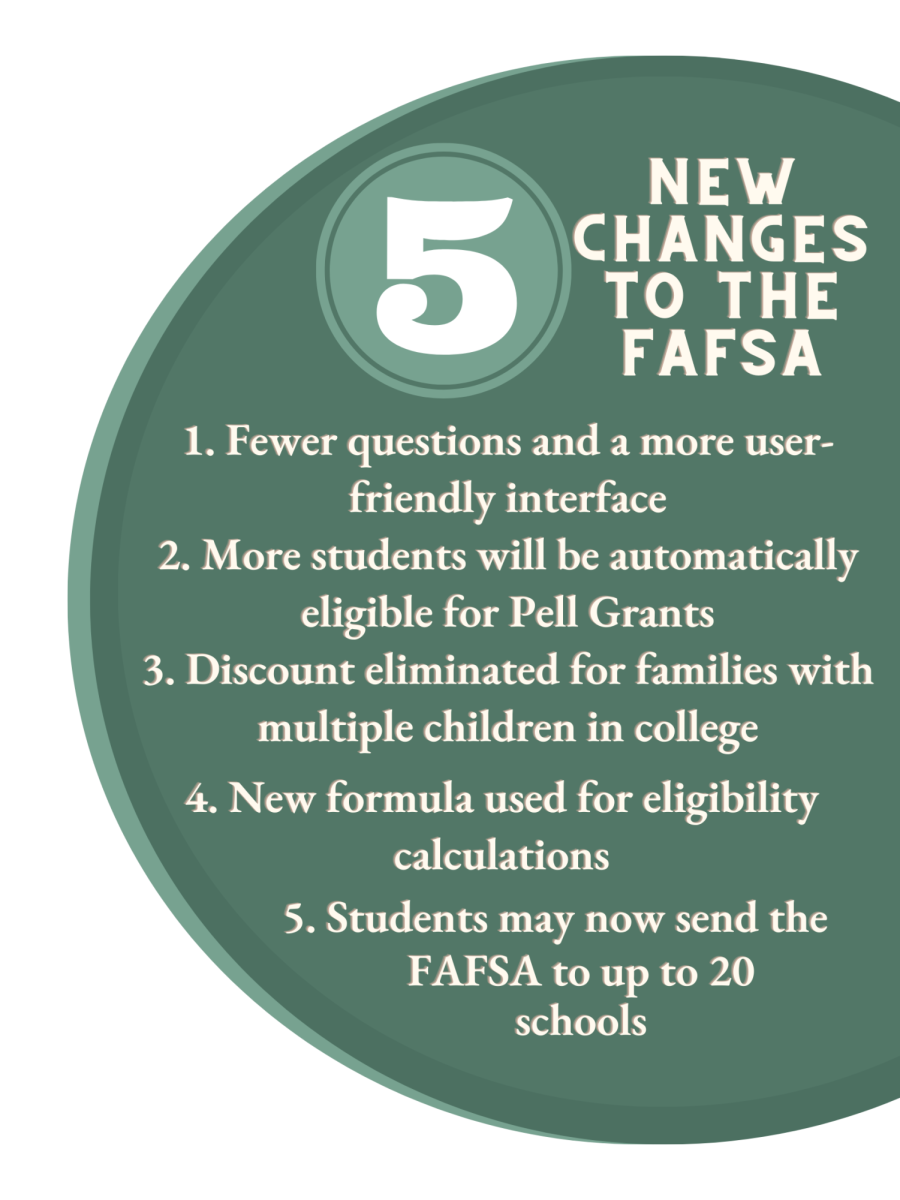

The Free Application for Federal Student Aid allows students pursuing higher education to submit their financial information to be reviewed for government-subsidized aid. This year, the FAFSA underwent changes to improve and expedite the process for students and families. However, these changes delayed the form by two months, causing panic and confusion for many SENIORS depending on financial aid to determine which college to commit to.

“Many students won’t make their decision until they have received their financial aid packages from their schools so they can see which one is more fiscally reasonable,” Tanya Ficklin, an 11-12th grade counselor, said. “It’s going to have a huge impact on our students and their ability to make those decisions in a timely manner.”

Historically, students have found the FAFSA form to be a long and tedious process, but some students found that the new changes made the process easier despite the delay.

“I can’t compare it to what it used to be,” Jada Turner, ‘24, said. “But I do know this year was very easy. It was pretty fast and the questions were pretty simple for me to answer.”

However, other students reported difficulty accessing help directly from FAFSA, including Kaylee Robbins, ‘24, who spent multiple hours on FAFSA and Social Security helplines.

“I spent over eight hours on hold collectively with Social Security, just for them to tell me that I called the wrong service [which FAFSA directed me to],” Robbins said. “And every time I called FAFSA they immediately hung up on me.”

Others experienced various technical glitches, which also prevented them from completing the application process.

“I was disappointed in how many glitches [the FAFSA had], considering that they pushed releasing it back for over two months,” Ficklin said. “With it being a government database, I expected it to be a cleaner transition than what families are having to experience. I don’t think that’s fair that they have so many glitches.”

While many students have now been able to submit the FAFSA form, delayed FAFSA-based aid packages from colleges present the next challenge for SENIORS.

“It’s just causing a lot of stress for students, and I know that financial aid is a big factor for a lot of kids [that determines] whether or not they can even go to college, much less pick their dream college,” Turner said.

The delay also limits the amount of time for students to commit to college after receiving their financial aid.

“It’s made it incredibly hard because now [financial aid is] not supposed to be sent out until mid-March, and with the commitment date being May 1st, that puts a lot of stress on students to make a really quick decision,” Turner said.

Due to this, a nationwide extension on this deadline has been proposed by multiple groups. Some colleges have already done so, including Kalamazoo College, Lewis & Clark College and Oregon State University.

“There are three different entities asking colleges to consider pushing that date back so that students have more time to analyze their financial aid packages,” Ficklin said.

Aside from the FAFSA, some students have either applied for or received merit-based aid from various schools.

“[Need-based aid] is pretty significant to me, but I’m working on getting merit-based aid as well. I’m hoping between the two, most of the cost could be covered,” Turner said.

Similarly, Willow Shannon, ‘24, has received merit aid from certain schools but is still relying on receiving the rest of her financial aid packages to make her decision.

“[The FAFSA delay] has definitely pushed [making my decision] back a lot,” Shannon said. “I’m in this really weird limbo where I’m down to two schools, but I don’t know where I’m going yet because I haven’t received those financial aid packages yet.”

Merit-based aid is especially helpful for students who will not qualify for aid based on the FAFSA, but it is still difficult to receive at many institutions.

“I think there’s a lot of gatekeeping as far as giving out financial aid to students,” Ficklin said. “It seems to be that middle-range or middle-income families miss out on [the FAFSA], and unless your student has a five-point GPA and gets a merit scholarship, the middle class misses out on financial opportunities to help their students go to college, which I think is unfair.”

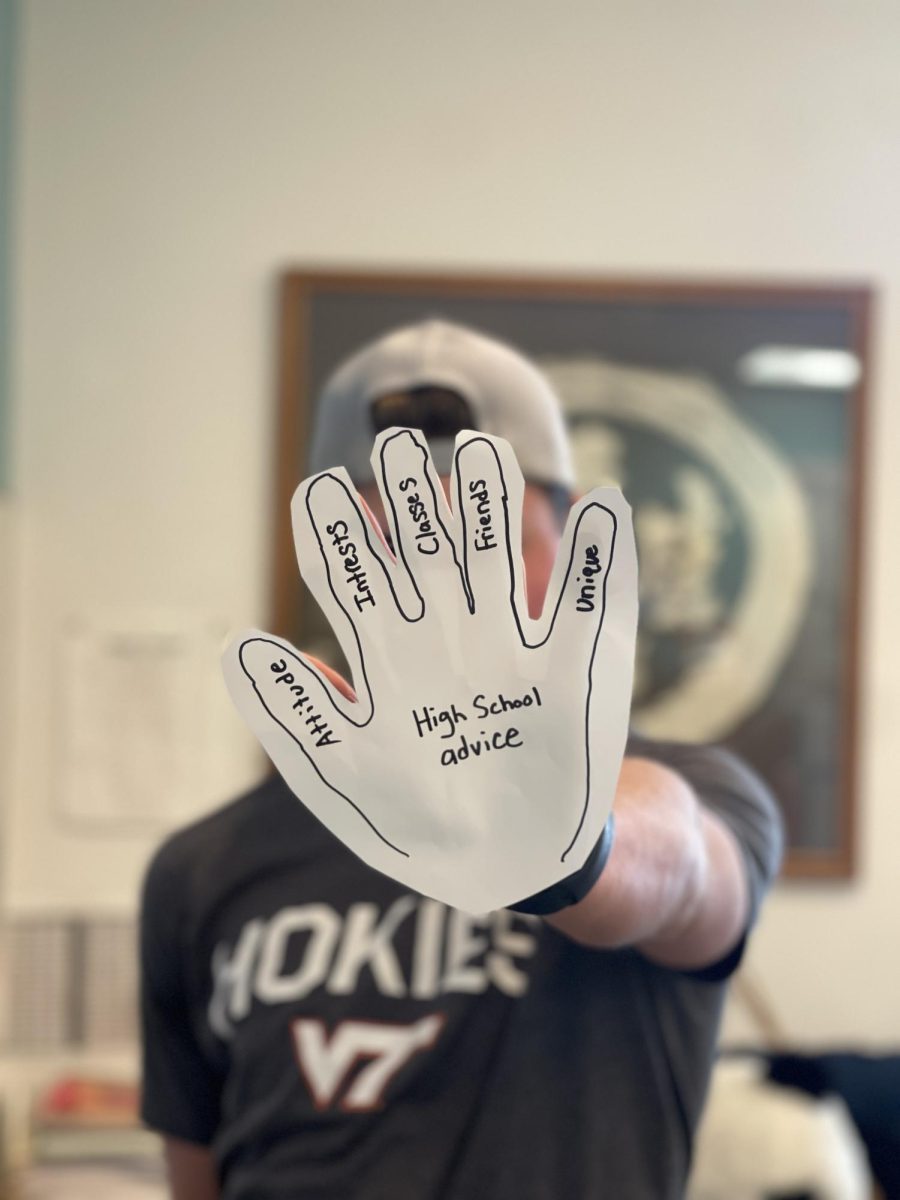

While students may face problems with both need-based aid and merit aid, Ficklin encourages students to pursue all options.

“Please fill [the FAFSA] out, even if you think you don’t qualify for anything,” Ficklin said. “Please fill it out because you never know — depending upon the cost of the school and depending upon what your family makes, you may qualify for something. You might be surprised,” Ficklin said.

For students still struggling to complete the FAFSA process, WHHS is hosting a FAFSA help night on Feb. 15 from 10-6 pm. Additionally, WHHS is hosting “Been There, Done That,” a program where juniors and their families can hear SENIOR parents’ experiences navigating the college application process, including the FAFSA and scholarship applications. Turner recommends that future students begin the FAFSA and general application process early.

“I [recommend] that you create an account at least a month before you want to fill out the form because it takes them a while to verify your information before you can even attempt to log in and fill out the form,” Turner said. “And also just realize that at the end of the day, this is out of your hands.”

Shannon also found it useful to research the FAFSA prior to the form’s release.

“[Beforehand,] I googled what the FAFSA looked like just to get an idea of what it would ask and how I might answer some of those questions… so I feel like [filling out the form] took less time,” Shannon said.

Once all financial aid is awarded, Ficklin advises students to consider all of the factors in the decision process and to find the best compromise.

“Take a deep breath and don’t stress because you have options,” Ficklin said. “Once you decide what’s most important, you can pick where you want to go.”

This story was originally published on The Chatterbox on February 14, 2024.