On Sept. 5, 2023, attorney Christopher Lee Kaufman and financial education non-profit founder Timothy J. Ranzetta proposed a ballot initiative to make one semester of financial literacy classes a high school graduation requirement in California.

If the measure qualifies for the 2024 ballot and is approved by voters, California would become the eighth state to make financial literacy courses mandatory.

These statewide measures attempt to fulfill an unmet need in schools, responding to studies like that by the Program for International Student Assessment (PISA), which concluded that 22% of American teenagers struggle with understanding essential financial concepts like budgeting, saving, investing, and managing debt.

The PISA results further indicated that American students’ financial literacy levels have remained stagnant over the past few years, highlighting the need for more comprehensive and effective financial education programs in schools.

“I firmly believe that students should be learning personal finance before college. It’s one of the few topics that students need to have a basic familiarity with, regardless of whether they’re going to college, what kind of college, what job they want to pursue, everybody truly needs it,” government and economics teacher Alex Gray said.

While in high school, Gray struggled to learn financial literacy due to an ineffective curriculum.

“My teacher just played ‘Shark Tank’ the whole time. She taught us how to balance our checkbooks, which people don’t balance their checkbooks anymore. That’s all I came out of economics knowing,” Gray said.

Advanced Placement (AP) United States History and Government and Economics teacher Elizabeth Bellas is also passionate about bringing financial literacy education to high school.

“I feel passionate that we should require financial literacy courses in school. I feel fortunate to teach [some aspects of financial literacy in] college prep Economics,” Bellas said.

While the college preparatory Economics class contains some lessons on financial literacy, the AP version does not, hence students who choose the accelerated class miss out on crucial financial skills. When students graduate, they’ll leave their AP Government class not knowing the crucial financial skills needed to pay taxes, spend responsibly, and build savings.

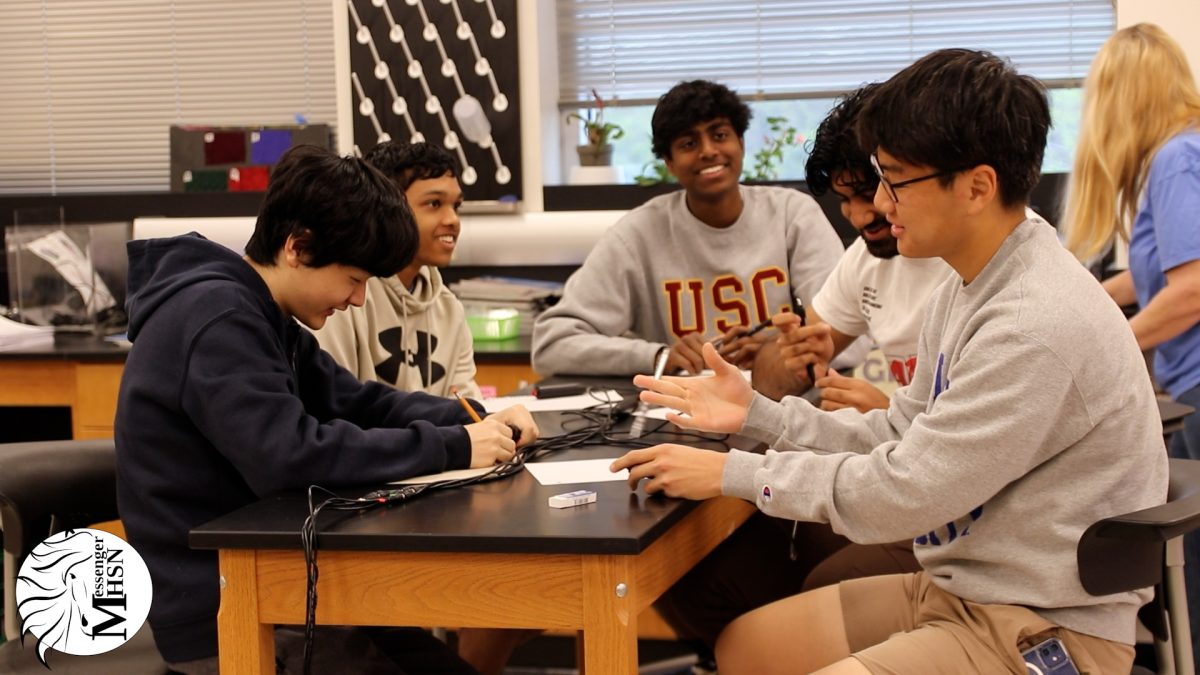

Sophomore Anya Maholtra, president of the Youth Business Club in Burlingame, started the club to help fellow students navigate entrepreneurship, basic finance, and accounting. She believes that financial literacy is crucial for the future and should be implemented in the school curriculum.

“I’m kind of figuring it out as I go with the club. But what I know is that it’s super key and very important to future success in life, for education, for paying for college, and eventually putting a mortgage on the house,” Maholtra said. “I just think it’s like the backbone of every important life decision. It’s super important to get all those values down in high school.”

Similarly to Maholtra, senior Isaac Van Voorhis works with Finatic, a non-profit organization that creates financial literacy lesson plans for schools. Their goal is to demystify financial literacy through engaging and innovative lessons.

Finatic also connects the over 26 schools in its network with financial literacy workshops and guest speakers to encourage students to hone their finance skills.

“I’m an outreach coordinator,” Van Voorhis said. “We’ve partnered with Bank of America so we’re able to use a lot of their speakers who are investment bankers or commercial bankers, and then provide that as a service to clubs so they can host members and have them talk to people.”

Finatic’s partnership exposes students to professionals such as investment and commercial bankers, destigmatizing financial literacy and helping students transition toward financial independence.

“The earlier you start investing and saving and making those smart financial decisions, the better,” Gray said. “If you wait until later and teach yourself personal finance after graduating from college, you’ve already lost several years when you could have been making money. There are all kinds of different ways to use your money wisely. And the earlier you do it, the better.”

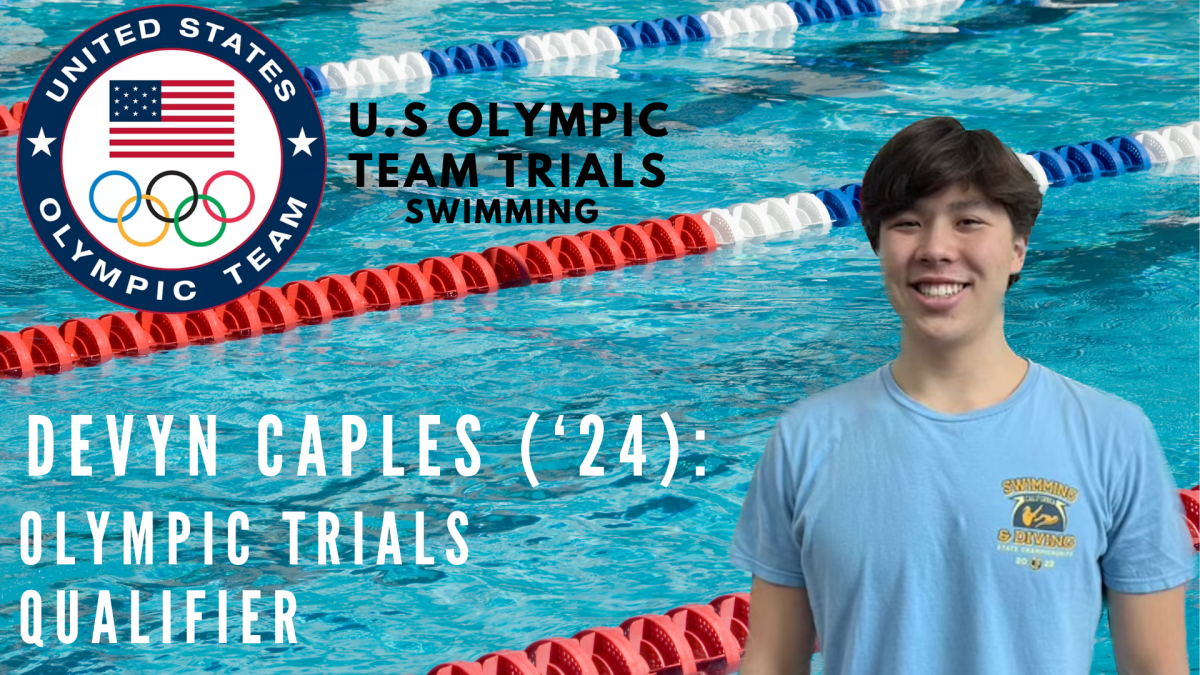

Van Voorhis has also written a book on basic investing for kids and teens that serves as an accessible and engaging introduction to the world of finance and investing. The book guides young adults through the process of making investments and entering the stock market.

“High school students presumably or like young adults are the biggest challenge I’d say because I think there aren’t too many expenses for most high schoolers. I think that tends to kind of cloud people’s judgment on how much they should spend,” Van Voorhis said.

Both Van Voorhis and Maholtra feel that a mandatory class would go a long way toward addressing financial literacy gaps by ensuring participation from all students, unlike a self-selecting course, which doesn’t guarantee full enrollment.

“I think even just a semester required in the course would incredibly skyrocket everyone’s future success. And I think it would also kind of stimulate a sort of skill that we aren’t taught in school, like life skills,” Maholtra said.

At the end of the day, it’s important to remember that financial literacy isn’t just managing money — it’s a life skill necessary beyond school.

“What’s cool about financial literacy is you can use it in a lot of aspects for doing service to your community,” Van Voorhis said. “And I think financial literacy is a great way to learn more while helping people.”

This story was originally published on The Burlingame B on March 5, 2024.

![It was definitely out of my comfort zone to get [the dress] and decide I loved it enough not to wait and risk not having something that memorable.](https://bestofsno.com/wp-content/uploads/2024/04/Precious_20180902_JRS_00008_ed1.jpg)

![Sophomore Sahasra Mandalapu practices bharatanatyam choreography in class. These new dances will be performed in an annual show in February. Mandalapu found that practicing in class helped her overcome stage fright during her performances. “When [I] get on stage, Im nervous Im going to forget, even though Ive done it for so long,” Mandalapu said. “Theres still that little bit of stage fright [when] I second-guess myself that I dont know it enough, but I do because Ive been practicing for a whole year.”](https://bestofsno.com/wp-content/uploads/2024/05/Sahasra-6-Large-1200x844.jpeg)

![In their full runway outfits, (from left) Audrey Lee 25, Olivia Lucy Teets, 25, Fashion Design teacher Ms. Judy Chance, and Xueying Lili Yang pose for a photo. All three girls made it to Austin Fashion Week by getting in the top 10 in a previous runway show held by Shop LC.

[I like my students] creativity and how they can look at a fabric and make it their own, Ms. Chance said.](https://bestofsno.com/wp-content/uploads/2024/04/IMG_9686-e1714088765730-1129x1200.jpeg)

![IN THE SPOTLIGHT: Junior Zalie Mann performs “I Love to Cry at Weddings,” an ensemble piece from the fall musical Sweet Charity, to prospective students during the Fine Arts Showcase on Wednesday, Nov. 8. The showcase is a compilation of performances and demonstrations from each fine arts strand offered at McCallum. This show is put on so that prospective students can see if they are interested in joining an academy or major.

Sweet Charity originally ran the weekends of Sept. 28 and Oct. 8, but made a comeback for the Fine Arts Showcase.

“[Being at the front in the spotlight] is my favorite part of the whole dance, so I was super happy to be on stage performing and smiling at the audience,” Mann said.

Mann performed in both the musical theatre performance and dance excerpt “Ethereal,” a contemporary piece choreographed by the new dance director Terrance Carson, in the showcase. With also being a dance ambassador, Mann got to talk about what MAC dance is, her experience and answer any questions the aspiring arts majors and their parents may have.

Caption by Maya Tackett.](https://bestofsno.com/wp-content/uploads/2024/02/53321803427_47cd17fe70_o-1-1200x800.jpg)

![SPREADING THE JOY: Sophomore Chim Becker poses with sophomores Cozbi Sims and Lou Davidson while manning a table at the Hispanic Heritage treat day during lunch of Sept 28. Becker is a part of the students of color alliance, who put together the activity to raise money for their club.

“It [the stand] was really fun because McCallum has a lot of latino kids,” Becker said. “And I think it was nice that I could share the stuff that I usually just have at home with people who have never tried it before.”

Becker recognizes the importance of celebrating Hispanic heritage at Mac.

“I think its important to celebrate,” Becker said. “Because our culture is awesome and super cool, and everybody should be able to learn about other cultures of the world.”

Caption by JoJo Barnard.](https://bestofsno.com/wp-content/uploads/2024/01/53221601352_4127a81c41_o-1200x675.jpg)