Entering high school in 2024 is much like the reaping in The Hunger Games. While going to school for four years and acquiring an education is quite different than being dropped into a free-for-all arena—and also involves a lot less gore, the penultimate goal of both situations is the same: absolutely decimate your peers, no matter the cost. These past couple of years have been a cutthroat competition between me and my classmates to see who could earn the highest GPA, who can participate in the most prestigious extracurriculars, and collect the most awards to brag about.

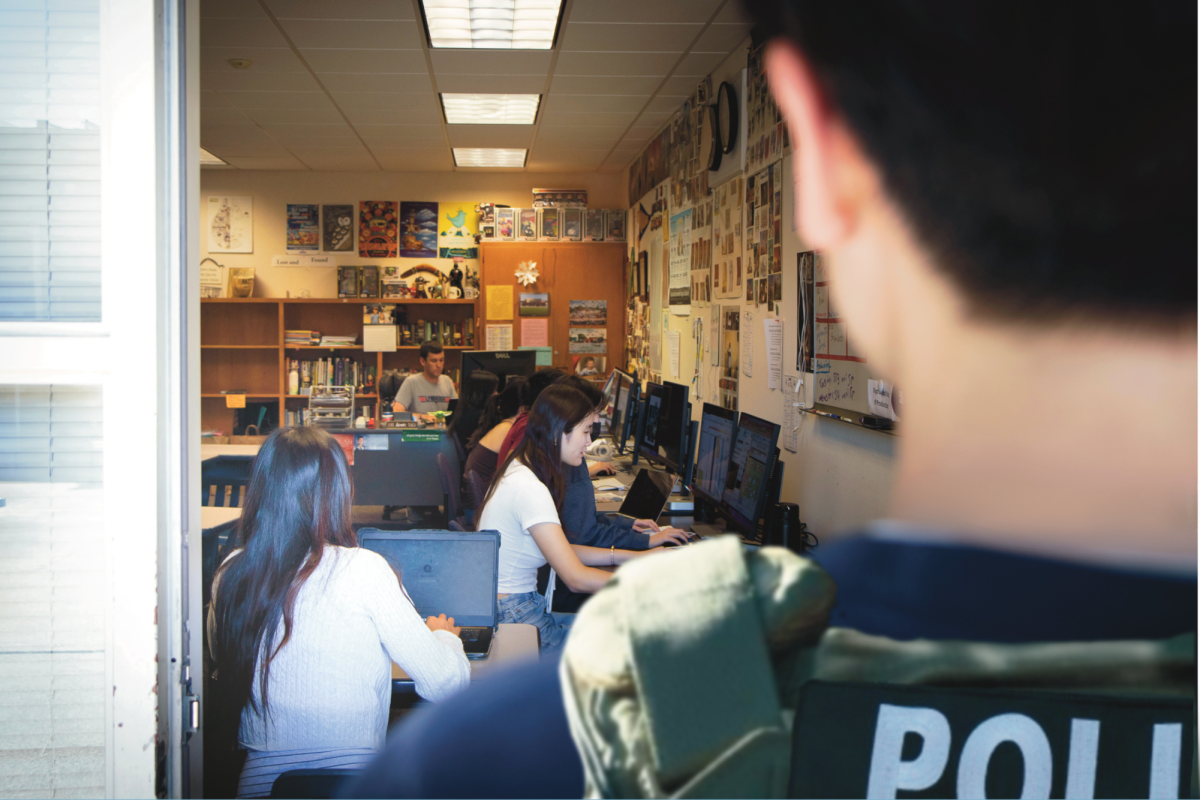

Yes, it’s dramatic, but it’s true. For students, there is a constant push for excellence that is perpetuated on a day-to-day basis. In schools, class ranks pit us against one another as everyone vies for a top spot. Online, there are communities dedicated to sharing what you’ve accomplished in high school for the sole purpose of comparing yourself to other students. And the closer you get to graduating, the more there’s an emphasis of crafting a portfolio full of achievements that you pray will impress potential colleges.

Over the years, it has become more difficult to stand out amongst a sea of increasingly competitive students. To be acknowledged as “exceptional,” it’s no longer enough to be valedictorian or participate in just a few after-school extracurriculars. You must take the highest level classes possible to inflate your GPA, score in the top percentile in standardized testing, and win national or even international level awards if you want to be considered for prestigious programs, internships, or universities.

Student Statistics 1990-2024 by Adrienne Marie Vera-Perez

Luckily for a select few, there is a quick and easy way to meet this threshold: simply pay your way to the top. Families can opt to pay thousands of dollars for tutoring and courses that will almost guarantee a student’s academic success. A quick Google search of “most successful SAT prep courses” will bring you to The Princeton Review, one of the most popular and successful standardized test preparation websites. And for the low, low price of only $364 an hour, it will almost guarantee you an SAT score of 1500 or above, putting participants well above the national average and at a competitive advantage. This doesn’t just apply for standardized testing, either. Private tutors are also readily available to coach students through any subject, providing one-on-one guidance and flexible schedules that school tutoring may not have. But these too are not accessible to the average American family, with the standard private tutor boasting rates of approximately $25 to $80 an hour, depending on the level of tutoring offered.

So where does this leave low income students? It’s definitely still possible to succeed academically through hard work instead of monetary programs. However, it makes it overwhelmingly more challenging to keep up with high income students and their abundances of support.

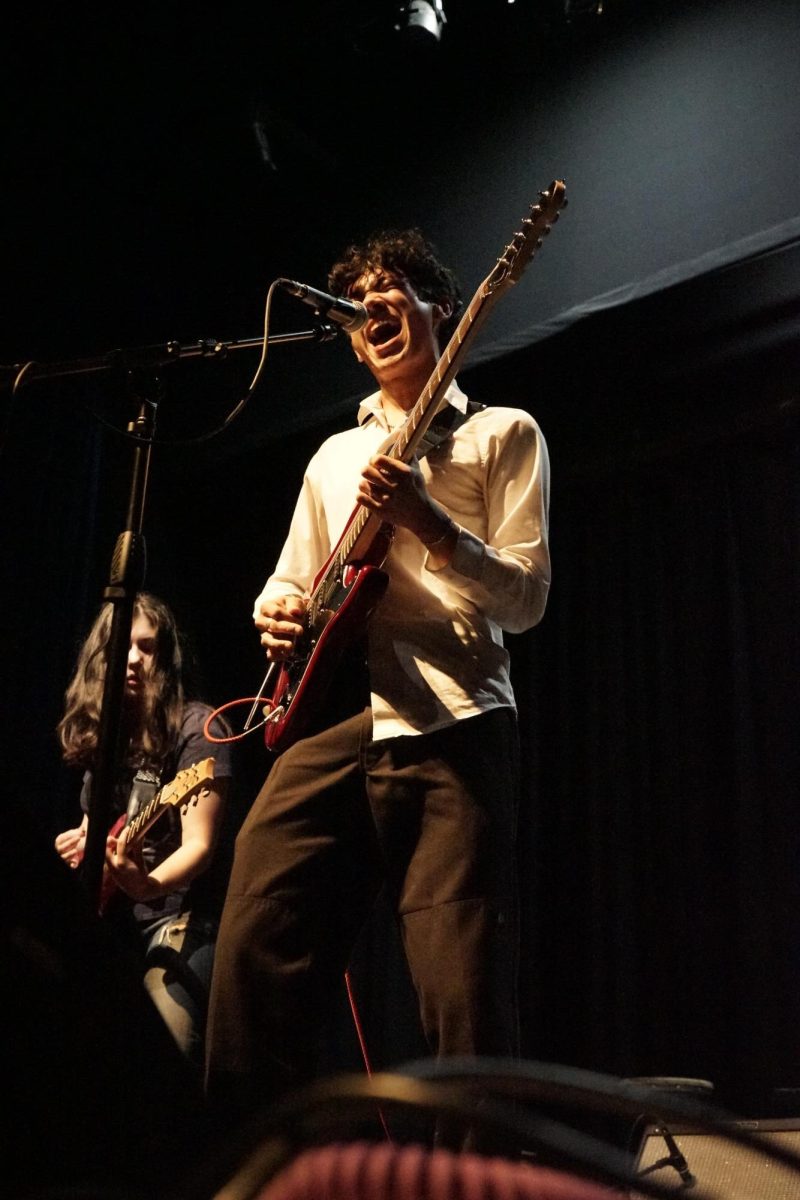

It also makes it more difficult for low-income students to develop their activities outside of school. Even if someone holds the prerequisites to participate in competitive, top-notch extracurriculars, it means very little if their financial status limits their ability to take advantage of those situations. Not everyone is able to pay thousands of dollars to travel to a national conference or register for distinguished pre-college programs. But in a lot of cases, these opportunities are where impressive awards and distinctions are most easily attained.

When your opportunities are limited, it also limits your future prospects. After high school, the next step is typically to enter a four year university to earn your bachelor’s degree. High achieving students everywhere dream of attending an elite college, whether it’s in the Ivy League or simply ranks high on US News. But your options get extremely limited when it comes to where you can go when you consider the cost of attendance.

To be able to afford elite, competitive colleges, low-income students often depend on the grants and scholarships that are offered to them by the institution and federal government in order to subsidize the cost of attendance. The FAFSA gives students access to need-based federal aid, and is often hailed as one of the primary ways that you are able to make college more accessible, but the maximum alloted is only $7,395. It’s no small amount, but when you compare it to, for example, Harvard’s annual cost of $82,886, the federal aid barely makes a dent. Merit-based scholarships are also extremely limited. While these are given out primarily by institutions, each scholarship varies in value, and rarely do they cover the full cost of tuition. Full rides are only awarded to top applicants to a college every year, and if a student’s financial situation is already affecting their ability to achieve, it will likely affect their probability of getting the aid needed to make it feasible to attend an elite university.

Whenever I think about this disparity, I tend to reminisce about my freshman year. As a fresh-faced 14 year old with bold aspirations, I dreamed about attending a top university and winning international awards. But as my lack of ability to pay killed my opportunities, it also killed those dreams. With every Ivy League college taken off my list and every school trip I was never able to go on, I felt myself become more compliant, more “realistic,” which I believe is the worst thing that could happen to a young mind. The same questions plagued my mind, and have influenced me when thinking about the path ahead. How will I finance my future? Am I still capable of accomplishing my goals? Am I still “exceptional” even though I fall under the poverty line?

My advice for anyone going through the same crisis is to look at all your options. Programs such as Questbridge and Upward Bound exist to give low-income high schoolers access to top colleges and opportunities, and that’s only to name a few that are out there. In addition, nearly $100 million in scholarships and $2 billion in grants go unclaimed every year. There is money out there, waiting to be claimed, that has the ability to help pay for your education. It’s easy to cry about how life isn’t fair (I know, because I did it a lot), but I suggest instead putting that effort into researching ways to close the economic gap, and work hard to succeed through those avenues. Instead of focusing on the factors you aren’t capable of changing, hone your attention and find the opportunities that are most accessible to you.

This story was originally published on Southwest Shadow on September 30, 2024.