Starting with the Class of 2027, West Shore will require students to take a semester-long Personal Finance and Money Management course to graduate. The mandate comes as a part of Florida Senate Bill 1054, which requires that all high school students take a financial literacy course to receive a Florida high school diploma. Offered in-person and online on Florida or Brevard Virtual Schools, the course will cover topics like wages, taxes, credit accounts and borrowing money.

“It is absolutely critical that as students enter the workforce, they have as much information to make the best decisions possible for themselves and their families,” Assistant Principal Glenn Webb said. “Not every kid comes out of high school and goes into college. Many go into trades or service industries, [but] they can still look out for their future if they understand how to make their money work for them in the long run and still have a balanced budget to live on.”

A report by Tyton Partners, an education-focused investment banking and strategy consultancy firm, found that “there is a lifetime positive benefit of approximately $100,000 per student from guaranteeing that a high school student takes a one-semester course in personal finance.”

“I do think that the kids are going to see relevance in it,” Principal Burt Clark said. “A lot of times we teach you guys things that, even though they’re interesting, you might think ‘this is not relevant to what I want to do in life.’ This is directly relevant to really everyone’s life, no matter how much you decide to invest or how you decide to use credit. Knowing these things are going to give you the opportunity to make better decisions, be more successful, be more financially stable and that’s good for everybody, not just that individual, but it’s good for the community and our overall economy.”

A “Roar” survey* involving the sophomore class and below revealed that only 8.6% of surveyed students believed they had a strong understanding of financial literacy concepts, while 48.7% believed they had a grasp of the concepts and 42.8% stated they haven’t learned or don’t understand how the concepts work.

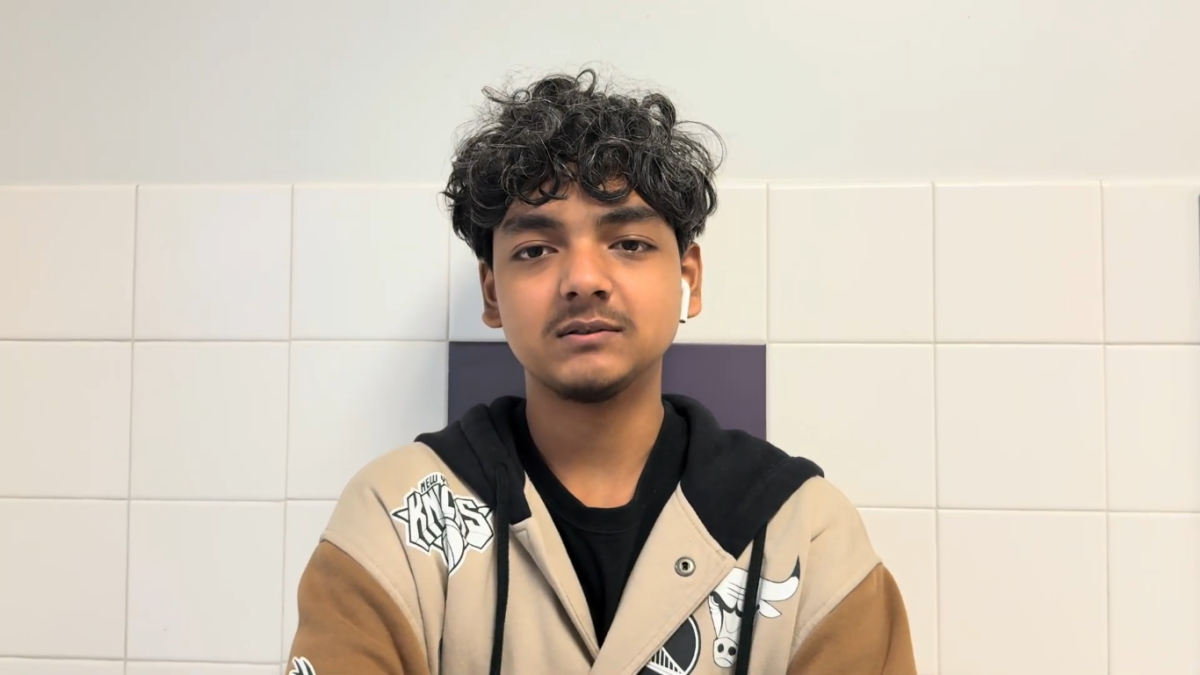

“Honestly, I don’t really know much about financial literacy other than what my dad has told me,” sophomore Joseph Konathapally said. “It’s more like I just follow what he does. I think this class is actually a really good idea and is going to help me a lot, especially when I’m in college, when I really won’t have time to take classes or invest in learning about financial literacy myself.”

College and career specialist Angela Feldbush said when going to college, students typically aren’t equipped with all the skills they need to be financially successful, and the course will provide useful information for them to have before they try to live independently for the first time.

“Even though most of our kids get Bright Futures scholarship money to help pay for college tuition, there’s still room and board, and there are still day-to-day expenses that they don’t necessarily have an idea of how much they’re going to be,” Feldbush said. “Some kids have jobs and are already used to providing their own spending money, but not all kids do. College is kind of that halfway point between dependence and independence, where students still might have some financial support and encouragement from family, but they also start understanding what it means to live within your own financial means and plan for the future.”

Clark also emphasized the necessity of the course as times have changed, with students becoming financially independent earlier than ever and “starting businesses or doing things that require them to make sound financial choices now.”

“In my generation, I think you either started working or you went to college,” Clark said. “Now, those lines are really blended because of all the different ways that you can make money. Kids are going to college, but they’re also running a photography business on the side, or they’re doing stuff on YouTube and so they need to be able to do those things simultaneously. This financial literacy course should help do a lot of that, and it just ensures that when students leave high school, wherever they’re going, college or career, they are able to make good choices and stay out of debt.”

Government and economics teacher Austin Glezen said the class will help students to minimize future stress and maximize financial stability.

“You guys are a couple years removed from being adults and going out into the real world,” Glezen said. “If you don’t start off well in the real world, you will have an uphill battle. So it’s more important to start strong, so you don’t have to worry about fighting later to get caught up.”

Starting next year, the class will be offered as a sophomore level class tied with Career Research and Decision Making. Current sophomores and freshmen who have already taken Career Research and Decision Making and want to take the course in school can pair it with a semester-long physical education course or virtual class.

The survey reported that 62% of students plan to take the course in-person, and 38% plan to take it online.

“I definitely plan on taking the course on Florida Virtual School,” sophomore Daniella Fassman said. “I’ve been planning my courses out for the past two years now for my junior year and senior year, because those are the two most important years before college. I think to just drop this financial literacy class on all of us our junior year as a graduation requirement is kind of just ridiculous.”

Fassman said she believes financial literacy ideas should be introduced in seventh and eighth grade, and built upon throughout high school.

“I know a lot of people in my grade have started working around the age of 16 or 17, once they’re able to drive,” Fassman said. “So it’s important that people understand financial literacy before they get to that point, not after they’ve already been into the working place. That knowledge is necessary for them to be able to thrive economically and sustain themselves throughout the rest of their lives.”

Having had a job for a few years, sophomore David Hartford said his parents initially advised him on how to manage his income and set up a bank account for him.

“Once you make your own money, you understand the cost of a dollar and you try to save it,” Hartford said. “I think that was a good lesson that I had to learn.”

Feldbush said that getting a job in high school can initiate financial conversations early on, and can build experience in making responsible financial decisions.

“The first time you get a job is probably when you start to think seriously about money,” Feldbush said. “Not only do you have disposable income for the first time, but it’s also the first time you have to think about filing taxes, and questions like ‘Do I want to spend money right away?’ or ‘Do I want to start saving money?’ Without having a good idea of why you need money and how much money you need, it’s hard to figure out [a] balance between working versus spending time going to school and doing other activities. So, a financial literacy class can help kids to start to understand how all of those pieces start to fit together.”

Feldbush said that the ultimate goal is to set students on the right track and prepare them for life’s unpredictable challenges.

“We all learn lessons and figure things out as we go along, but I think the class will help kids to have a plan in place,” Feldbush said. “Even if that plan has to change, it’s good to start with a plan so that you feel confident going forward about having enough money to support yourself in life.”

*The data was gathered from a Google Forms survey via 7th-10th grade homeroom classes on Jan. 31, 2025, to 187 students.

This story was originally published on The Roar on April 16, 2025.